Most financial services companies can’t crack the top search rankings, even though they outspend other industries on SEO. The numbers tell the story – 76% of them struggle with this challenge.

Recent years have transformed financial SEO services completely. Your finance company faces a unique challenge – you’re not just competing with other businesses but also dealing with Google’s tougher algorithms that scrutinize financial content more strictly. Banks, investment firms, and fintech startups need specialized SEO strategies. Research shows financial websites take 37% more hits from core algorithm updates than other sectors.

Trust signals matter twice as much for financial websites compared to other industries, making a finance SEO expert’s role vital. Google puts credibility first when users look for financial information. That’s why financial institutions need a unique SEO approach that showcases expertise and builds authority.

This piece will help you create a detailed SEO strategy built specifically for financial services. We’ll explore everything you just need to outrank competitors in 2025 and beyond – from becoming skilled at E-E-A-T principles to implementing technical improvements that boost your site’s credibility.

The Evolving Landscape of Financial SEO in 2025

Financial SEO has revolutionized by 2025. Search engines now review financial content with extra care, which makes old optimization methods less effective. Your financial institution must understand these changes to keep and boost search visibility.

- Key Changes in Search Engine Algorithms

Google updates its algorithm approximately 500-600 times each year. Several major updates have affected financial websites specifically. The search engine now knows how to review content quality beyond basic keyword matching. Google’s August core update of 2024 targeted poor SEO content and rewarded high-value resources. This change significantly impacted financial websites.

Financial service content belongs to the YMYL (Your Money or Your Life) category, which brings special implications. Google sets higher quality standards for these pages because they can directly affect users’ financial well-being. The search engine’s quality raters give extra attention to financial websites and look for harmful content.

The E-E-A-T principle (Experience, Expertise, Authoritativeness, Trustworthiness) guides financial SEO success. Adding “Experience” as the first “E” marks the biggest recent change. Assessors now look at both content creators and website operators.

- Rising User Expectations in Financial Services

Financial consumers search with more complex needs now. Voice search has altered keyword strategies. Users prefer longer, conversational queries instead of short phrases. They ask complete questions like “What’s the best SEO strategy for financial companies in 2025?” rather than typing “best financial advisor”.

80% of top-ranking websites work well on mobile devices. Google ranks and indexes mainly mobile versions of content. Financial institutions must prioritize mobile-first design.

Search engines use engagement metrics as quality signals. Click-through rates, time on page, and bounce rates matter more than ever. Your financial content needs to rank well and keep visitors interested.

- Competitive Analysis of Top-Ranking Financial Websites

Semrush data from August 2025 shows Yahoo.com guides financial websites with 3.94 billion monthly visits. Paypal.com follows with 783.82 million visits. Users view 4.52 pages per visit on average across top financial sites. Binance.com achieves the highest engagement with 11.33 pages per visit.

Top financial websites maintain bounce rates below the industry average of 44.29%. Caixa.gov.br’s bounce rate stands lowest at 24.0%. Reuters.com shows the highest at 73.72%.

These metrics prove that successful financial websites excel at attracting traffic and providing valuable content. This matches Google’s emphasis on content quality and user experience as key ranking factors.

Your financial institution needs an SEO strategy that showcases expertise, optimizes for mobile, and creates engaging content. An experienced finance SEO expert can help achieve these goals effectively.

Mastering E-E-A-T Principles for Financial Credibility

Trust is the lifeblood of successful financial SEO strategies in 2025. Google gives extra weight to E-E-A-T (Experience, Expertise, Authoritativeness, and Trustworthiness) principles, especially for financial websites. Google’s systems prioritize content with strong E-E-A-T for topics that affect financial stability. Here’s how you can become skilled at these critical principles to boost your rankings.

- Demonstrating Experience in Financial Content

Experience—the first E in E-E-A-T—shows your first-hand knowledge and hands-on involvement with financial services. You can show this by:

- Show, don’t just tell: Use visual content like graphs, explainer infographics, and real-life examples that highlight your practical expertise

- Incorporate customer testimonials: Let clients leave reviews after using your services to confirm your experience

- Share real-life applications: Use phrases like “when I previously encountered this problem, this is what I did” to show practical expertise

Note that experience helps identify whether your content creators have enough involvement with financial processes to write about them credibly. To name just one example, a mortgage advisor explaining loan processes carries more weight than generic advice.

- Establishing Expertise Through Author Credentials

Expertise shows you know to provide reliable financial guidance:

- Feature qualified content creators: Your financial content should be authored or reviewed by industry experts

- Create detailed author bios: List job titles, qualifications, years of experience, and social profiles

- Highlight relevant credentials: Add certifications, degrees, and professional memberships where they matter

NerdWallet sets a good example by creating detailed profiles of their authors, editors, and reviewers. These profiles explain their experience and certifications while linking to their LinkedIn profiles. If you don’t have in-house subject matter experts, qualified freelance reviewers from professional networks can help.

- Building Authority in Your Financial Niche

Others recognize your site’s authority as a valuable source over time:

- Earn quality backlinks: Get links from respected financial publications like Bloomberg, Forbes, or The Wall Street Journal

- Produce original research: Run surveys or gather unique data others will reference

- Participate in industry discussions: Join conversations with financial leaders on social media platforms and forums

Your intellectual influence grows by sharing unique insights. Forbes Advisor earned 291 backlinks from high-authority sites through a survey about financial advice on social media.

- Creating Trustworthy Financial Resources

Trust matters most among all E-E-A-T aspects. Build trust by:

- Secure your website: Use current SSL certificates and clear privacy policies

- Provide transparent information: Explain fees, terms, and potential risks clearly

- Cite reliable sources: Use reputable institutions and published studies

- Make contact information available: Show multiple contact methods and respond quickly to questions

Check facts carefully and use trustworthy sources to support claims. Financial websites need trust signals like author information, editorial review processes, and clear advertising relationships.

- Case Studies: E-E-A-T Success Stories

Financial brands using E-E-A-T well get real results:

- NerdWallet: Their author profiles include experience, certifications, and LinkedIn links, plus details about their editorial review process—building trust signals users value

- Forbes Advisor: Their unique data on millennial and Gen Z financial advice sources earned 291 quality backlinks from authority sites

- Self Financial: They link primary sources for every fact, showing exact URLs and access dates, which helps internal teams keep content current

These examples show how financial SEO specialists can turn E-E-A-T principles into practical strategies that improve search rankings and user trust.

These E-E-A-T best practices will help you meet Google’s strict requirements for financial content and build real credibility with your audience—making it work for any finance SEO expert.

Strategic Keyword Targeting for Financial Services

Financial SEO services in 2025 need precise keyword targeting to succeed. Financial services demand accuracy and deep knowledge of how users behave, unlike general SEO approaches.

- Understanding Search Intent in Finance

Search intent in finance goes beyond simple categories. Financial service searchers usually have specific goals. Your content will better serve their exact needs if you understand these intentions:

- Informational intent: Users seek to learn about financial concepts or services (e.g., “what is a free checking account”)

- Commercial intent: Pre-transactional searches compare features of similar financial products

- Transactional intent: Users want to purchase specific financial products or services

- Navigational intent: Searches target specific financial institutions or pages

Your niche’s keyword analysis reveals how users progress through their customer trip. To cite an instance, someone who searches “investment advice” needs different information than someone searching “open investment account online.” Content that matches these specific intents will rank better and convert more for SEO for financial services.

- Competitor Keyword Gap Analysis

A keyword gap analysis shows valuable terms where your competitors rank but you don’t. Look at 2-3 competitors who rank well in your financial niche. Tools like Semrush, Ahrefs, or Moz help you spot:

- Keywords where competitors rank higher

- Valuable financial terms you haven’t targeted

- High-potential keywords within reach

Results should focus on keywords that have traffic potential, reasonable ranking difficulty, and business value. Every finance SEO expert knows search volume alone isn’t enough—your financial services’ relevance and ranking difficulty matter more.

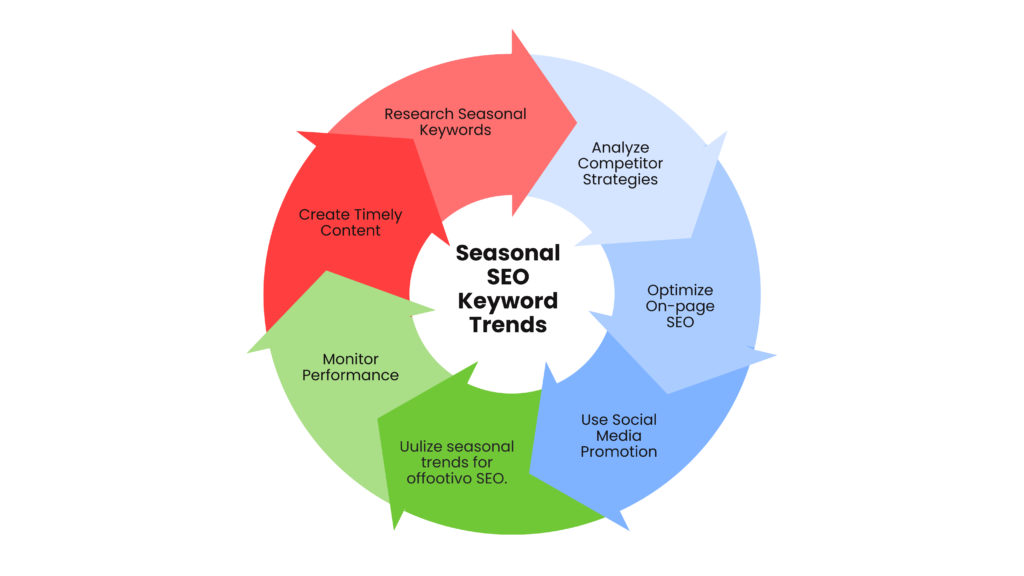

- Seasonal and Trending Financial Keywords

Seasonal patterns substantially affect financial services keywords. These patterns help you manage content timing throughout the year. Here’s why:

Financial businesses see predictable changes in consumer search habits during tax season, end-of-year financial planning, and major economic events. Your content calendar should follow these seasonal patterns to stay ahead of competitors.

Content creation should start 4-6 weeks before seasonal peaks. This timing helps you rank before search volume increases. This strategy works well for tax preparation, retirement planning, and year-end financial review keywords.

These three elements of keyword targeting help you create content that satisfies both search engines and users. This foundation helps any financial SEO specialist compete better in 2025’s digital world.

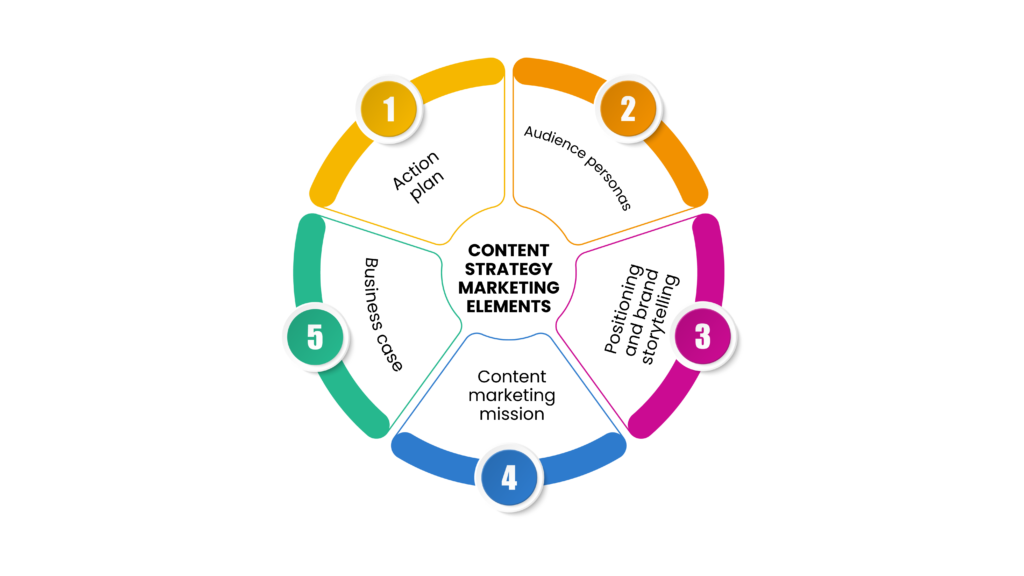

Developing a Comprehensive Content Strategy

Good content creates real results for financial services. A strategic content development approach builds credibility and moves prospects through your conversion funnel. Research shows that 63% of investors want informative, educational content from financial advisors.

- Content Mapping for Financial Customer Journey

The best content maps match each stage of your customer’s financial experience. Your first step should be developing detailed buyer personas and understanding their path to conversion. This groundwork lets you tackle specific pain points at every stage.

Customer journey mapping shows all the ways clients connect with your financial institution. A clear view of these interactions reveals key insights about customer behaviors, engagement patterns, and friction points. Data-driven improvements turn basic transactions into meaningful relationships.

- Creating Conversion-Focused Financial Content

Great financial content answers one key question: “What’s in it for me?” Your prospects need different things based on their demographics and where they are in their journey. Retirement-age customers want information about social security benefits. Young professionals connect better with long-term investment strategies.

Here’s how to create content that converts:

- Fix specific financial pain points

- Customize based on audience data

- Stay professional but relatable

- Share knowledge in simple terms

- Build trust through honest, clear communication

Financial institutions that use their data well can spot patterns, predict outcomes, and tailor their content offerings.

- Using Data and Statistics Effectively

Data analysis leads to smarter content decisions. Smart use of data helps financial institutions enhance products, personalize services, and understand customer groups better.

Original research and surveys make your content stand out. Forbes Advisor got hundreds of quality backlinks by doing their own research on financial advice sources. A mix of internal and external data enables quick decisions that boost overall results.

- Content Formats That Engage Financial Audiences

Your financial audience responds to different types of content. Try these formats:,

- Educational articles and guides – Build trust with clear, reliable information

- Interactive calculators – Show clients possible financial outcomes

- Video content – Break down complex financial ideas

- Infographics – Present financial data clearly

- Webinars – Teach specialized topics in detail

Studies show financial blogs with “Guide” in the title get three times more organic traffic. Adding both “How To” and “Guide” works even better.

- Content Calendar Planning for Finance SEO

A well-planned content calendar keeps your financial content consistent and timely. Your calendar needs target keywords, topic clusters, publication dates, and content briefs.

The best SEO for financial institutions calendars include key financial events like tax season, market reports, and economic milestones. Publishing 4-6 weeks before peak seasons gives content time to rank before search volume rises. This organized approach brings more qualified leads to your financial services.

Technical Optimization for Financial Websites

Technical infrastructure serves as the foundation of successful financial SEO services. Search engines can’t access your pages when technical problems exist. This creates a poor experience that makes visitors leave. Here’s a look at the technical elements that help financial websites build credibility and rank better.

- Site Architecture Best Practices

Your site’s architecture can make or break both user experience and SEO results. We focused on these key elements for financial websites:

- Navigation that your audience understands, not just your internal team

- URLs that tell both users and search engines what’s on the page

- Smart internal linking that spreads link value and connects related content

A proper header tag structure (H1, H2, H3) helps search engines understand your page layout. This organization matters even more for SEO for financial institutions because it shows professionalism and builds trust.

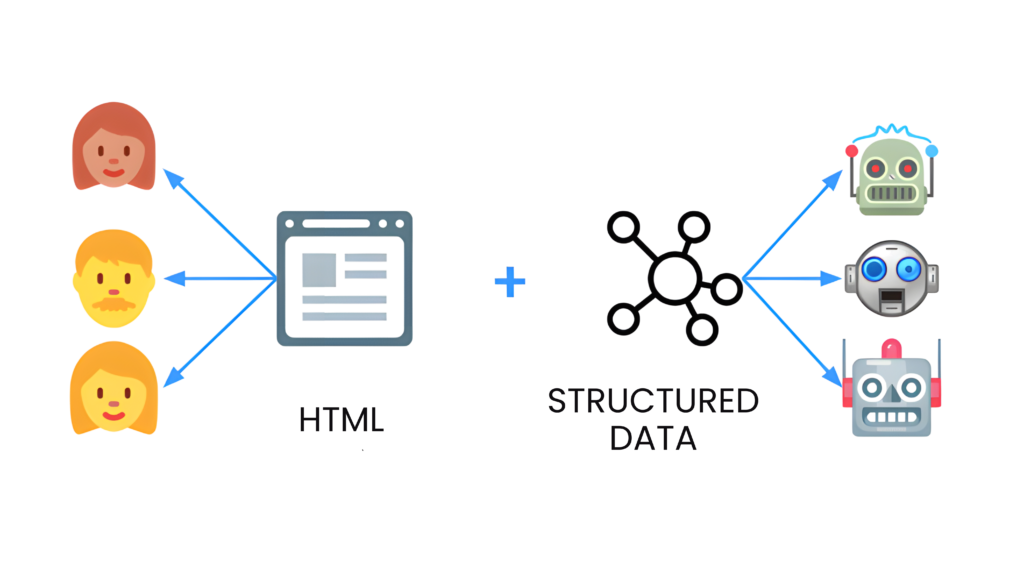

- Structured Data Implementation

Search engines understand and sort financial content better with structured data. Rich snippets created from structured data boost visibility in search results. Pages with structured data see a 25% higher click-through rate than those without it.

Schema.org provides specific markup options for financial services:

- BankOrCreditUnion markup shows your institution details

- FinancialProduct schema highlights services and products

- PriceSpecification displays fees and rates

Your finance SEO expert can use these to showcase services, branches, and support information in search results.

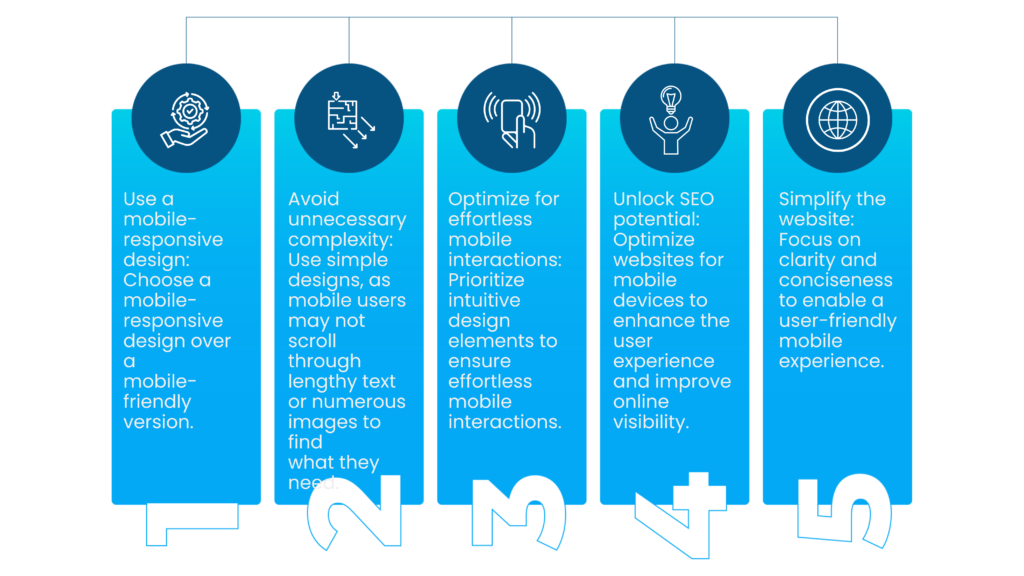

- Mobile-First Indexing Preparation

Mobile Googlebot became Google’s default crawler in July 2024. Your financial website must work well on mobile devices. 63% of Google searches happen on mobile, but only 13% of websites keep their rankings across devices.

Getting ready for mobile-first indexing means:

- Using responsive design that works on all screens

- Making text easy to read with tappable elements

- Keeping content similar on mobile and desktop versions

- Page Experience Optimization

Core Web Vitals measure speed and stability that shape user experience on financial websites. An SEO for finance companies specialist should:

- Speed up pages by optimizing images and JavaScript

- Set up HTTPS security to protect user data

- Fix crawl errors, broken links, and redirects

- Look for duplicate content

A reliable technical foundation supports all finance SEO efforts, especially when performance and security matter most.

Measuring and Improving Your Financial SEO Performance

The difference between successful and unsuccessful financial SEO services lies in how well they measure their metrics. You need proper measurement to understand what you get from your investment.

- Key Performance Indicators for Financial SEO

Your bottom line depends on the right metrics. Search engines bring unpaid visits through organic traffic, and organic conversions show you how many visitors fill out your forms. The bounce rate tells you when visitors leave after seeing just one page. High bounce rates usually mean your content doesn’t match what users want.

Your pages should load in 2-5 seconds. Slower loading times make visitors leave quickly and hurt your rankings. The click-through rate shows how many people click your link when it appears in search results.

- Setting Up Proper Analytics Tracking

Google Analytics helps you track visitor behavior, where traffic comes from, and conversion numbers. You’ll learn more about your search performance by connecting it with Google Search Console.

Tools like Semrush offer Position Tracking, Backlink Audit, and Site Audit features. These features help you measure organic keyword rankings, authority score, and overall site health.

- Regular SEO Audits and Adjustments

SEO audits are the foundation of any strategy that works. A complete review shows what’s working and what needs improvement. You should check:

- Search engines must crawl your indexed pages well

- Your backlink growth through referring domains

- Content quality and user experience to keep visitors engaged

- Competitor Benchmarking

Looking at your competition gives you a good way to measure your progress. Research shows companies that invest heavily in SEO are 13 times more likely to see positive returns.

Learn about your competitors’ content strategies, backlinks from trusted finance websites, and YMYL compliance. You can find keyword opportunities where competitors rank poorly using tools like UberSuggest, Ahrefs, and Semrush.

- Reporting SEO ROI to Stakeholders

Your stakeholders want results, not activities. Show them:

- Money made from organic traffic

- How much do you spend to get each customer compared to other channels

- How key categories are growing

Show a clear ROI by comparing the money made through organic search against what you spent on SEO. Think of SEO as building an asset that grows over time instead of a regular expense.

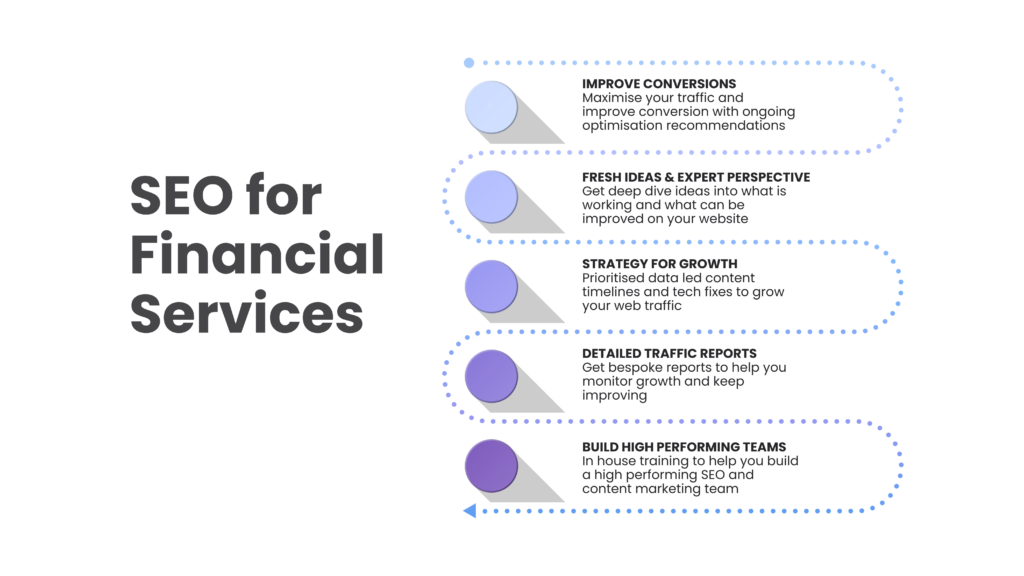

Why Choose Rankfast As Your Finance SEO Expert

Your choice of partner for financial SEO services directly impacts your results. Rankfast, your finance SEO expert, brings specialized knowledge to digital marketing for financial institutions.

Recent Google data shows 63% of consumers track their finances online. This digital presence matters more than ever. Rankfast has completed over 250 projects worldwide and worked with financial institutions and major brands like MasterCard.

Rankfast stands out with their integrated approach to building trust in the finance sector. Their content marketing strategies build credibility, as companies with blogs generate 67% more leads.

Results drive Rankfast’s approach. Their services combine full SEO audits, keyword research, competitive analysis, and backlink strategies. A client reached more than 100 keyword rankings on Google SERP with 20+ keywords in the top 10 results.

Rankfast goes beyond the basics with:

- Solutions that match your financial niche

- A team skilled in financial marketing

- Tested strategies with proven ROI

- Fresh approaches using modern tools and trends

- Multiple payment options

- Budget-friendly plans without extra selling

Quality content arrives on time, which helps financial institutions rank better and build trust in their sector.

Conclusion

SEO strategies for financial services need a special approach that is different from usual practices. This guide shows how Google sets higher standards for financial websites because of their YMYL classification. Building trust through E-E-A-T principles is the lifeblood of any successful financial SEO campaign in 2025.

Algorithm updates now target financial content quality faster than before. Your SEO strategy must adapt to these changes. Search engines and users trust websites that combine technical optimization, complete content mapping, and smart keyword targeting.

However, Rankfast creates custom digital marketing for financial services to solve your specific challenges. They focus on building trust and getting you the visibility needed to attract qualified leads. Their team has handled over 250 successful projects worldwide and worked with major financial brands.

Take the first step toward better rankings and more credibility today. Rankfast gives you the expertise to beat competitors while meeting Google’s strict financial content rules, whether you need full SEO services or targeted PPC for B2B companies. Your path to financial SEO success starts with a partner who knows both search engines and your industry’s needs.

FAQs

Q1. How will SEO for financial services evolve by 2025?

SEO for financial services in 2025 will focus heavily on building trust through E-E-A-T principles, mobile optimization, and creating high-quality, user-focused content. Search engines will place even greater emphasis on credibility and expertise for financial websites.

Q2. What are the key components of a successful financial SEO strategy?

A successful financial SEO strategy includes mastering E-E-A-T principles, strategic keyword targeting, comprehensive content planning, technical optimization, and regular performance measurement. It’s crucial to demonstrate expertise and build authority in your specific financial niche.

Q3. How can financial institutions improve their website’s E-E-A-T signals?

Financial institutions can improve E-E-A-T signals by showcasing author credentials, providing transparent information about their services, citing reliable sources, securing their website, and earning quality backlinks from respected financial publications.

Q4. What technical optimizations are essential for financial websites?

Essential technical optimizations for financial websites include implementing a clear site architecture, using structured data, ensuring mobile-friendliness, optimizing page speed, and maintaining proper security protocols like HTTPS.

Q5. How can financial companies measure the success of their SEO efforts?

Financial companies can measure SEO success by tracking key performance indicators such as organic traffic, conversions from organic search, keyword rankings, and backlink growth. Regular SEO audits and competitor benchmarking are also crucial for ongoing improvement.

Leave a Reply